On APRIL 15, 1865, President Lincoln died. He was shot the night before in Ford's Theater.

On APRIL 15, 1912, the Titanic sank. It struck an iceberg the night before.

Among the 1,514 lives that were lost were millionaires John Jacob Astor the Fourth, Benjamin Guggenheim and Isa Strauss, all of whom opposed the creation of the Federal Reserve Bank.

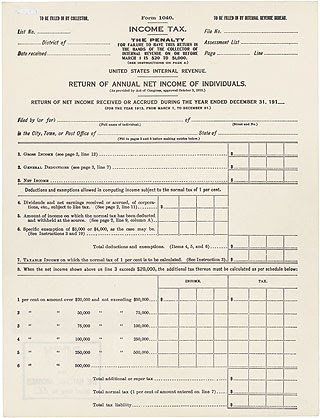

Originally, the U.S. Constitution prohibited a direct Federal Income Tax on American citizens, Article One, Section Nine:

"No capitation or other direct tax shall be laid, unless in proportion to the census or enumeration hereinbefore directed to be taken."

The Federal Government's revenue was derived from Excise Taxes on specific items like salt, tea, tobacco, etc., and Tariff Taxes on imports.

Prior to the Civil War, most tariff taxes were collected at Southern ports, like Charleston, South Carolina.

Tariffs made foreign goods more expensive so people would buy domestically produced goods, made mostly in Northern factories.

The South had few factories, as its economy was based on agricultural crops, mostly cotton and rice, which unfortunately relied heavily on slave labor.

Thus, the tariff taxes that helped the North, hurt the South.

During the Civil War, Republican President Abraham Lincoln passed an emergency "Revenue" Tax on personal incomes which raised $750 million to help fund the Union.

It was repealed in 1873 after the emergency of the Civil War was over.

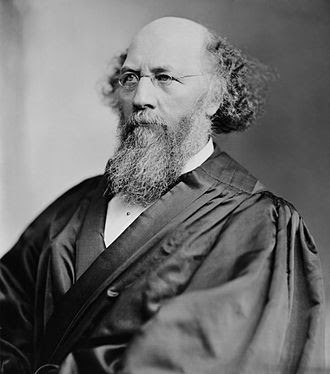

The first non-emergency "peacetime" Income Tax was attempted in 1894, but the Supreme Court declared it unconstitutional in Pollock v Farmers' Loan.

Chief Justice Melville W. Fuller understood income tax to exist only during the emergency of wartime:

"The original expectation was that the power of direct taxation would be exercised only in extraordinary exigencies, and down to August 15, 1894, this expectation has been realized."

Justice Stephen J. Field concurred:

"The income tax law under consideration ... is class legislation.

Whenever a distinction is made in the burdens a law imposes or in the benefits it confers on any citizen by reason of their birth, or wealth, or religion, it is class legislation, and leads inevitably to oppression and abuses ..."

Justice Field continued:

"It is the same in essential character as that of the English income statute of 1691, which taxed Protestants at a certain rate, Catholics, as a class, at double the rate of Protestants, and Jews at another and separate rate."

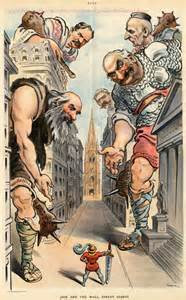

Industrialists helped bring about the greatest rise in the standard of living for the average person, with more goods at cheaper prices, than ever before in world history.

Industrialists then began to create monopolies, buy politicians, control political parties, and plot to gain control of the national banking system.

Republican President Theodore Roosevelt attempted to limit their power with an inheritance tax.

Republican President William Taft yielded to mounting public pressure to tax the rich industrialists by placing a 2 percent tax on corporate profits, as only the wealthiest owned corporate stock.

With the emergency of World War One threatening, Democrat President Woodrow Wilson naively thought there would be world peace if tariff taxes between countries were eliminated.

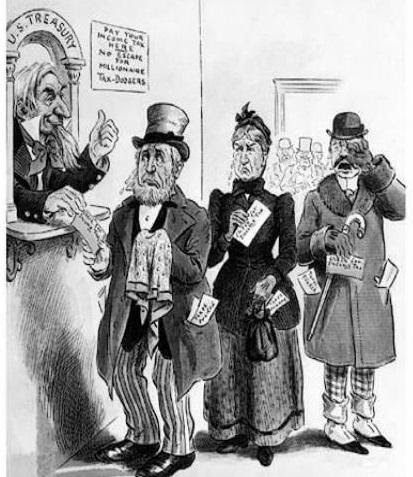

Wilson proposed replacing the lost tariff revenue with an income tax on the wealthy. This was passed in 1913 with the 16th Amendment.

Originally, the Income Tax Rate started as a one percent tax on the top one percent richest people.

It maxed out with a seven percent rate on those making over $500,000 a year (equivalent to $15 million a year in 2022 dollars).

It was a "soak-the-rich" tax, only intended for industrialists such as:

- Rockefeller,

- Carnegie,

- Vanderbilt,

- Fisk,

- Flagler,

- Gould,

- Harriman,

- Mellon,

- J.P. Morgan, and

- Schwab.

Industrialists strategically avoided paying the Income Tax by transferring their assets into tax-exempt charitable and educational foundations, such as the Rockefeller Foundation and Carnegie Foundation.

This tax-exempt category had previously been created for churches, which historically were the providers of social welfare through their:

- hospitals,

- medical clinics,

- orphanages,

- schools,

- soup kitchens, and

- care for orphans, widows, maimed soldiers, prisoners, unwed mothers, widows, shut-ins, homeless, juvenile delinquents, and immigrants.

Churches also provided a significant social service by starting schools and Sunday schools, being involved in education which instilled morals and virtues into students and the nation's population at large.

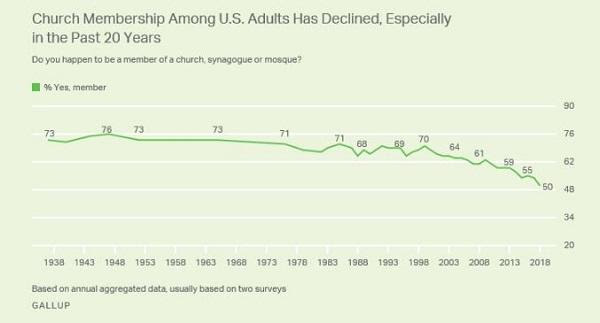

From the 1930s to the 1970s, regular church attendance in the United States was over 70 percent.

This helped strengthen marriages and families, meet community benevolence needs, and encourage youth to become responsible and caring adults.

Commands in Scripture are given to five groups:

- Individuals;

- Families;

- Business;

- Church;

- Government.

There are no commands for the family to do that. Family commands are mostly relational, such as husbands love your wives, and children submit to your parents.

There are no commands for business to take care of the poor. Commands to business are: employees -- give an honest day's work; and employer -- do not hold back wages.

There are commands for the church to take care of the sick, poor and strangers, and for 2,000 years the church has been faithful to fulfill these responsibilities, by feeding orphans and widows, founding hospitals, caring for shut-ins and elderly, visiting prisoners, etc.

There are NO commands for the government to take care of the poor, provide education, or take care of sick. The commands to the government are the shortest: protect the innocent and punish the guilty.

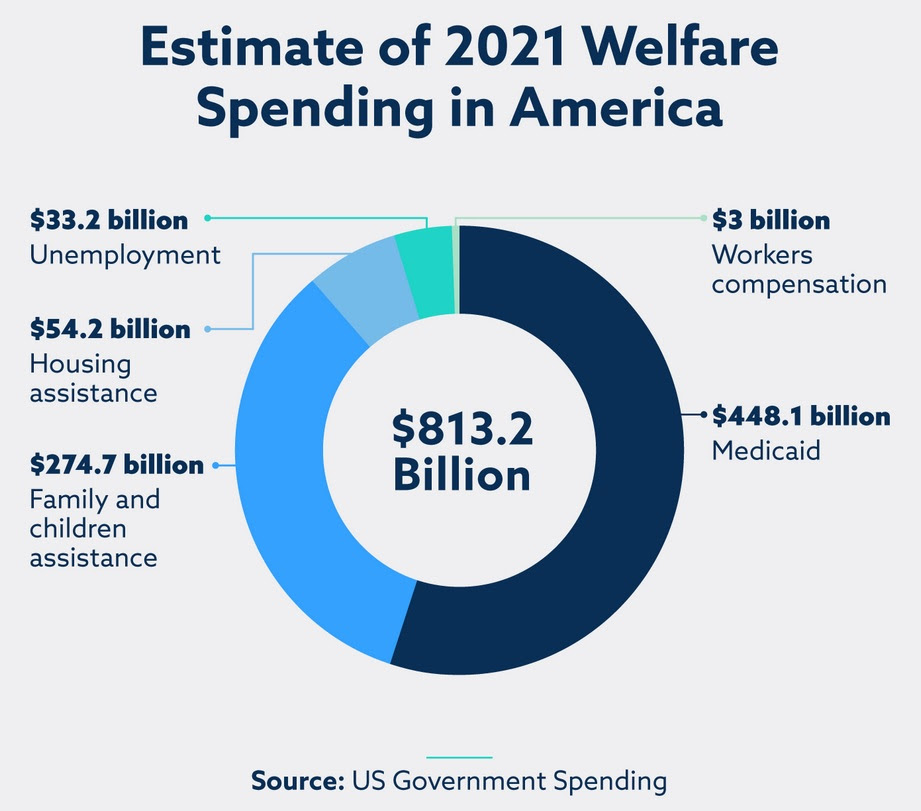

What has happened, especially since Franklin Roosevelt's New Deal and Lyndon Johnson's Great Society Welfare State, is that the government has usurped the responsibilities of the Church.

Where churches ministered to the poor for free out of religious motivations and generous voluntary charitable donations, government social welfare programs are an immense financial burden, in many cases the largest items on state budgets, which taxpayers have no choice but to involuntarily pay.

It is not charity when it is involuntary.

Early Christian believers sold their property and laid the money at the feet of the APOSTLES for the CHURCH to redistribute;

NOT at the feet of PILATE for the ROMAN GOVERNMENT to redistribute.

Just because something needs to be done does not mean it is the government's job to do it.

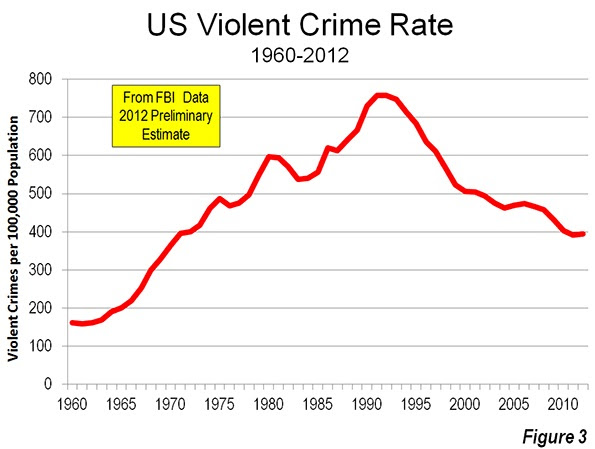

Over time, as church attendance declined, and media, the entertainment industry, and government-run public schools have replaced the church's traditional morality, there appears to be a corresponding increase in social ills, domestic instability, crime, drug abuse, homelessness, sex-trafficking, divorce, broken homes, child abuse and sexual promiscuity,

Oxford anthropologist J.D. Unwin, in his 1934 book Sex and Culture, confirmed that after studying 80 civilizations over 5,000 years, that monogamous heterosexual marriage precedes cultural advancement, and sexual promiscuity always precedes civilizational collapse.

British historian Arnold Toynbee examined the development of 22 major world civilizations and found that they start to decay when they lose their moral fiber and deep-state cultural elites turn parasitic:

"Of the twenty-two civilizations that have appeared in history, nineteen of them collapsed when they reached the moral state the United States is in now."

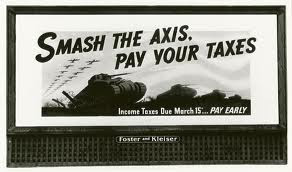

In 1942, during World War Two, Democrat President Franklin Roosevelt expanded the Federal Income Tax with "the greatest tax bill in American history," even instituting paycheck withholding.

Billboards displayed: "Smash the Axis, Pay Your Taxes."

John F. Kennedy explained April 20, 1961:

"In meeting the demands of war finance, the individual income tax moved from a selective tax imposed on the wealthy to the means by which the great majority of our citizens participate in paying."

Beardsley Ruml, chairman of Macy's Department Store, became director of the New York Federal Reserve Bank where he promoted the idea of withholding taxes from people's paychecks.

Kennedy explained, April 20, 1961:

"Withholding ... on wages and salaries (was) ... introduced during the war when the income tax was extended to millions of new taxpayers."

Businesses gradually became subject to:

- Higher Taxes;

- Higher Wages & Benefits;

- More Lawsuits;

- More Governmental Bureaucracy;

- More Environmental Restrictions; and

- Political Favoritism or "cronyism" toward some companies who hired expensive lobbyists and were politically connected, while others companies were not.

After decades of hostile business conditions, those companies not receiving favoritism were faced with a choice:

go out of business;

or

go out of the country to reduce costs.

As companies outsourced jobs to stay competitive globally, patriotic attachments diminished, giving rise to financial globalists.

John F. Kennedy noticed this, February 6, 1961:

"I have asked the secretary of the treasury to report on whether present tax laws may be stimulating in undue amounts the flow of American capital to the industrial countries abroad."

Kennedy told Congress, April 20, 1961:

"In those countries where income taxes are lower than in the United States,

the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States."

To remedy this, Democrat President John F. Kennedy proposed a stimulus plan of lowering taxes across-the-board, as he stated September 18, 1963:

"A tax cut means higher family income and higher business profits and a balanced Federal budget.

Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education, and investment.

Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the Federal Government will ultimately end up with more revenues."

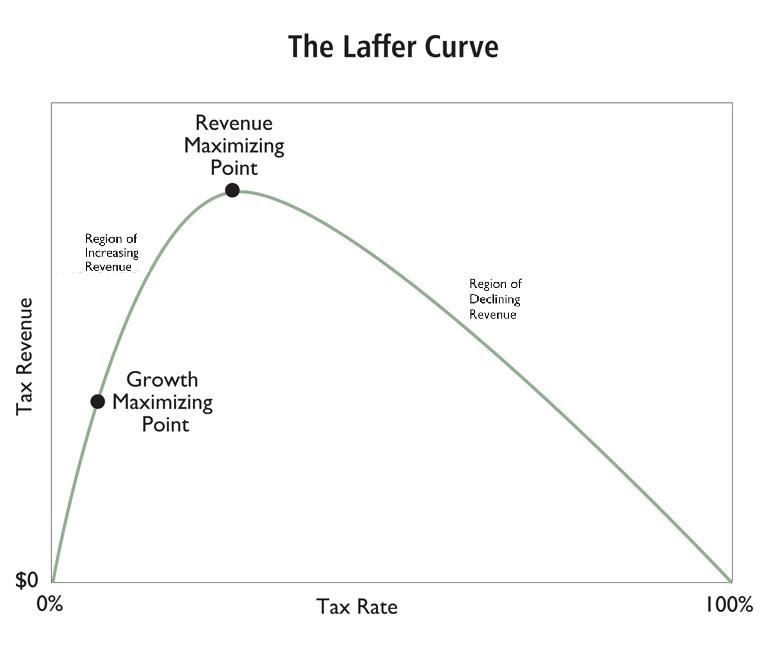

Kennedy stated January 17, 1963:

"Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased - not a reduced - flow of revenues to the federal government."

Kennedy stated, November 20, 1962:

"It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now ...

Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus."

Kennedy stated in his Annual Message, January 21, 1963:

"In today's economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the Federal deficit - why reducing taxes is the best way open to us to increase revenues ...

It is no contradiction - the most important single thing we can do to stimulate investment in today's economy is to raise consumption by major reduction of individual income tax rates."

JFK mentioned in his Message to Congress on Tax Reduction, January 24, 1963:

"Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort -- thereby aborting our recoveries and stifling our national growth rate."

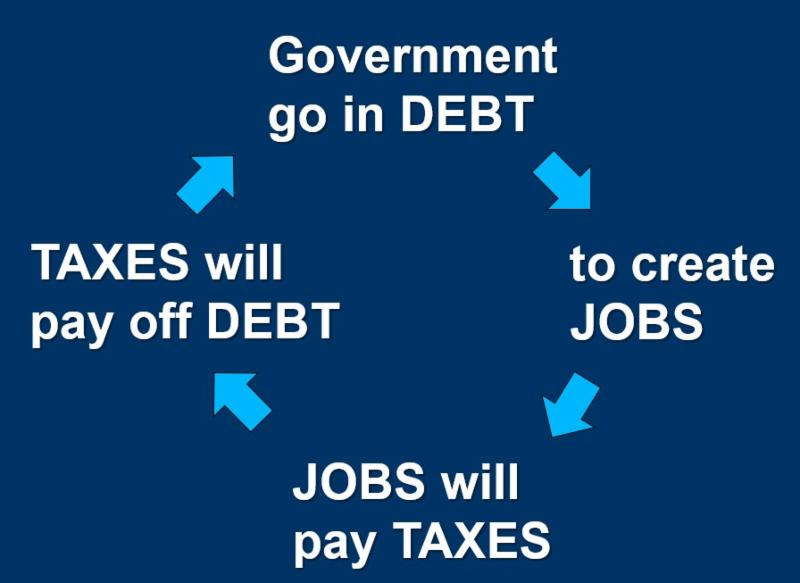

Where Kennedy wanted to reduce taxes to stimulate the economy, economist John Maynard Keynes had proposed stimulating the economy by going in debt.

John Maynard Keynes reasoned that:

- if the government went in debt

- spending money in the private sector to create jobs,

- those jobs would pay taxes and

- pay off the debt.

Unfortunately, politicians were always tempted to continually increase debt in order to funnel money to constituencies, supporters, and pork projects in their districts so as to help them get reelected, leaving the next Congress with the responsibility to pay off the debt, which, unfortunately, they never do.

James Buchanan, Jr., observed this phenomenon.

He received the Nobel Prize in Economics in 1986, for his examination of how politicians make economic policy decisions.

He discovered politicians tend to vote to increase debt so they can direct money to their districts, as this will help their reelection -- but they will not vote for corresponding tax increases to pay for it -- as this will hurt their reelection.

Buchanan indicated that, rather than being disinterested public servants, a large percentage of career bureaucrats are primarily interested in getting re-elected.

Self-preservation is a powerful motivator.

It is natural for people to want to keep their jobs.

But when millions of people work for the government this results in them wanting the government to get bigger and bigger as job security.

This grows into an enormous "deep-state" bureaucracy of individuals who are tempted to use their positions to perpetuate their jobs, while harassing, auditing, leaking, investigating, and prosecuting those threatening to eliminate their government jobs.

The Keynesian debt-stimulated economy model has resulted in an unsustainable $30 trillion U.S. National Debt, which makes the United States the most in debt nation in world history.

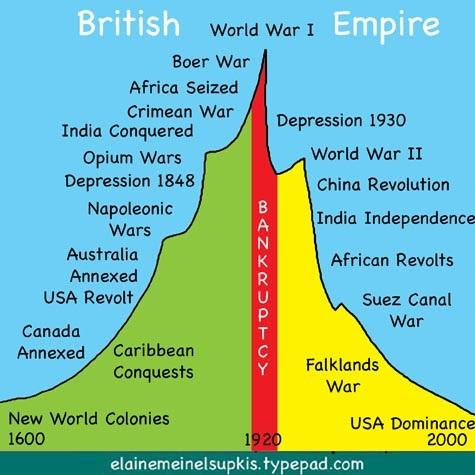

Many civilizations, empires and republics throughout history accumulated enormous amounts of debt right before their decline:

- Roman Empire under Diocletian;

- Mongolian Empire under Yuan ruler Toghan Temür;

- Florence under Italian Medici banking family;

- Spanish Empire under Philip the Third;

- Holy Roman Empire during Thirty Year War;

- French Empire after Seven Years War, and finally under Louis the Sixteenth;

- The Confederacy during Civil War;

- Ottoman Empire under Abdül Hamid the Second;

- Russian Empire under Tsar Nicholas the Second during World War One;

- British Empire after World War One and Two.

Union of Soviet Socialist Republics tried to keep up with Reagan's U.S. military spending during the Cold War "arms race."

The Soviet economy was overwhelmed with debt and collapsed, resulting in the Berlin Wall coming down.

In an ironic twist, in the decades since the fall of the Soviet Union, the United States has followed in instituting upon itself similar debt spending policies.

Regarding this socialist tendency of the government increasing spending, President Gerald Ford stated in Rock Hill, SC, October 19, 1974:

"What they don't tell us when they propose all these benefits that they are going to give you from our Government ...

that a government big enough to give us everything we want is a government big enough to take from us everything we have."

Similarly, President Donald J. Trump stated February 18, 2019:

"The more power they get, the more they crave.

They want to run healthcare, transportation, finance, energy, education ...

Socialism is not about justice, it's not about equality, it's not about lifting up the poor ... it's about one thing only: power for the ruling class."

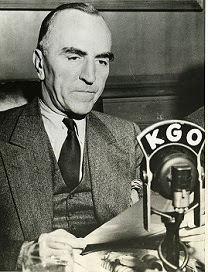

World War One fighter Ace Eddie Rickenbacker, who owned the Indianapolis Speedway and Eastern Airlines, wanted to repeal Woodrow Wilson's 16th Amendment Income Tax, stating:

"When Woodrow Wilson told us of the evils of concentrated power, less than 9% of our entire national income was enough to keep all of the federal and local governments going ...

By 1960, taxes took ... one third of all our earnings, and the Federal Government ... spent 70% of that ...

The entire gross income of every American is subject to complete Federal confiscation ..."

Rickenbacker continued:

"Every time the liberals discover a brand new misinterpretation of the Constitution,

every time they invent a new way to circumvent the constitutional limits of the Federal power,

they pile up more power in Washington at the expense of individual liberty across the land ...

Instead of advocating freedom, modern liberals were striving to pile up the power of government in Washington."

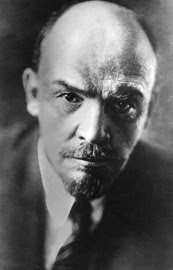

On the other side of the world, Vladimir Lenin's plan to institute socialism included eliminating business owners who could challenge his power.

He is credited with saying:

"The way to crush the bourgeoisie (middle class) is to grind them between the millstones of taxation and inflation."

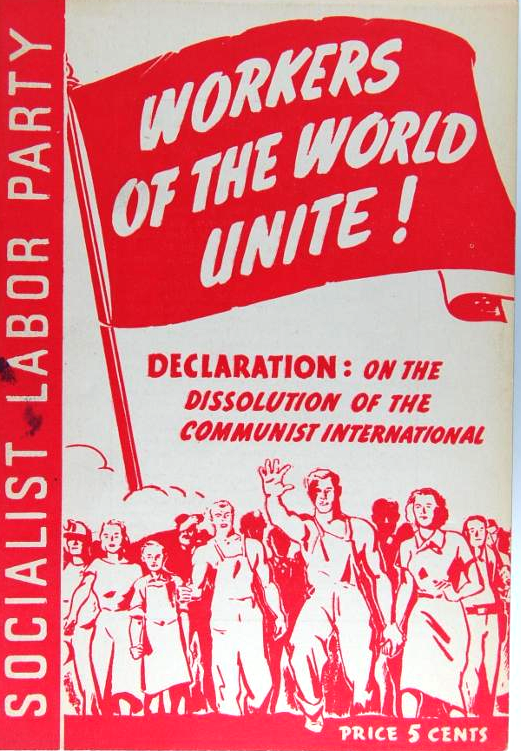

After the 1917 Bolshevik Revolution in Russia, Communist labor organizers, community organizers, agitators, and agent provocateurs (provoking agents) began infiltrating other countries, including the United States.

Lenin considered socialism an international transition phase from capitalism to communism, stating:

"The goal of socialism is communism."

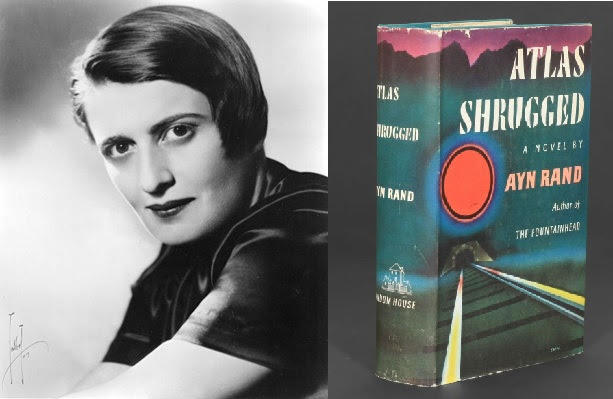

Ayn Rand wrote in “Foreign Policy Drains U.S. of Main Weapon” (The Los Angeles Times, Sept. 9, 1962):

"There is no difference between communism and socialism, except in the means of achieving the same ultimate end: communism proposes to enslave men by force, socialism — by vote. It is merely the difference between murder and suicide."

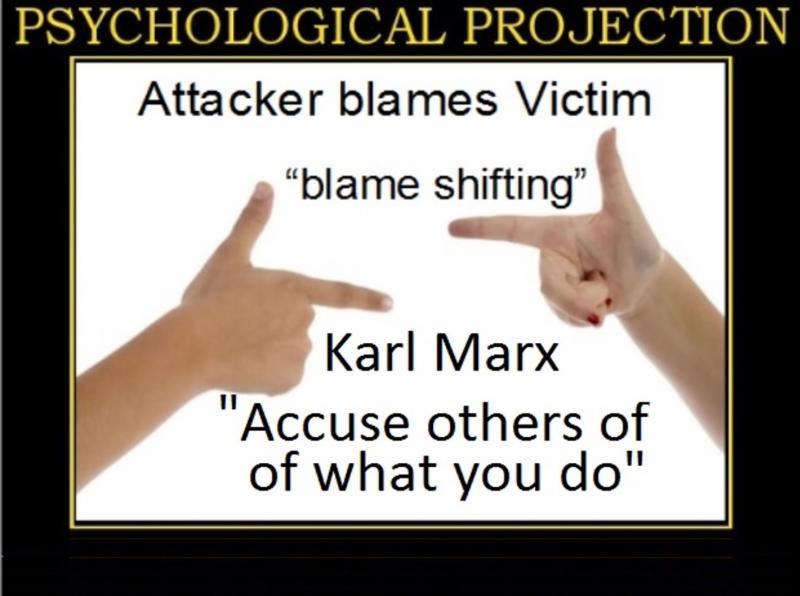

In order to overthrow governments, socialists utilized tactics of stirring up class-struggle and psychological projection or "blame-shifting" where the attacker blames the victim.

Sigmund Freud wrote in Case Histories II (PFL 9, p. 132) of "psychological projection" where humans resort to the defensive mechanism of denying in themselves the existence of unpleasant behavior while attributing that exact behavior to others.

A rude person constantly accuses others of being rude.

Marx is attributed with the phrase "Accuse the victim of what you do" or "Accuse your opponent of what you are guilty of."

In an NPR interview, April 19, 2010, political advisor David Axelrod verbalized this tactic:

"In Chicago, there was an old tradition of throwing a brick through your own campaign office window, and then calling a press conference to say that you've been attacked."

Fox News contributor Charlie Hurt stated (Hannity, May 23, 2019):

"This whole thing is like this game of projection ...

Whatever they accuse President Trump of doing we then find out not only did President Trump not do it, but they did it."

Politically groups formed tax-exempt educational foundations to fundamentally change the government by instigating a workers' revolution.

Individuals naively recruited to join their ranks were referred by the Leninist term "useful idiots."

Those accused of being communist agitators were defended by Roger Baldwin, who founded a tax-exempt organization in 1917, to defend those who were draft dodgers during World War One.

It was renamed the ACLU.

In 1921, Margaret Sanger founded the tax-exempt organization to eliminate "human weeds" and promote racial "purification."

It was renamed Planned Parenthood.

The growth of tax-exempt organizations advocating change resulted in the Congress limiting what tax-exempt organizations could do politically.

Commenting on the tax burden of a growing government, President Ronald Reagan remarked at the National Space Club Luncheon, March 29, 1985:

"Personally, I like space. The higher you go, the smaller the Federal Government looks."

Albert Einstein's accountant, Leo Mattersdorf of New York, wrote (TIME Magazine, 1963):

"One year while I was at his Princeton home preparing his return, Mrs. Einstein, who was then still living, asked me to stay for lunch.

During the course of the meal, the professor (Einstein) turned to me and with his inimitable chuckle said: 'The hardest thing in the world to understand is income taxes.'"

Reagan stated in 1988:

"I believe God did give mankind unlimited gifts to invent, produce and create.

And for that reason it would be wrong for governments to devise a tax structure that suppresses those gifts."

--

American Minute is a registered trademark of William J. Federer. Permission granted to forward, reprint, or duplicate.

Thank you for your wonderful site, pennings, offerings, readings, and TRUTH.

TRUTH knowledge, versus lies and propoganda, is the most sweetest succulent chocolate rolled and savored across the tongue and throughout the closed mouth to taste and digest the true sweetness of the taste of TRUTH for as long as possible.

Although you pen The 16th Amendment was “passed”, it was never EVER ratified properly, was instituted illegally and unConstitutionally, and, to this day, “The Tax Courts” sanction/levy heavy financial penalties/fines/jail for ANYONE trying to use non-ratification as evidentiary defense in US “Tax Courts” which are themselves illegal and unConstitutional. The US has a “two-tier” ridiculous corrupt Court system(s) … regular Courts and SEPARATE “Tax Courts” … along with Congress illegally and unConstitutionally granting IRS law-making powers. ONLY Congress can create/pass laws CONSTITUTIONALLY. The WHOLE f/u/k/n thing is an illegal unConstitutional s/h/y/t show of eponymous epidemic proportions instituted by some of the most godless heathen criminal treasonous traitors to The US throughout history (to present) that were and are late for the gallows poles. The Second American Revolution, Civil War II, whatever the h/e/l/l you want to call it is coming. There is no stopping it. Plutocratic oligarchs NEVER relinquish power and control via Vote nor negotiation … once they have power they will NEVER relinquish it voluntarily. Mao, for all the filth and evil he was, proselytized it best, “power, all, comes from the barrel end of a gun”. It is inevitable. Timing is simply based upon how much the bourgeoisie will put up with … and for how long.