Money supply has a mixed history.

Originally, wealth was measured in precious metals of gold, silver, or copper.

Exodus 25:3 "And this is the offering which ye shall take of them; gold, and silver, and copper."

Items of gold, silver, or copper had to be weighed.

Fixed units of weight were:

- bekah,

- half-shekel,

- shekel, and

- talent.

One talent was equal to about 75 lbs.

Bekah, half-shekels, shekels and talents were placed on one side of a scale and on the other side were placed the items of gold, silver, or copper to be weighed.

The Bible admonished not to cheat, Deuteronomy 25:13 "Do not have two differing weights in your bag -- one heavy, one light." (NIV)

In the 6th century BC, King Croesus of Lydia is credited with being the first to mint coins, a mix of gold and silver called "electrum," which had a specific weight and image stamped on it.

Croesus, who was associated with the legend of King Midas' gold, asked Greek leader Solon who was the happiest man.

Solon, because of the fickleness of fortune, responded, "Count no man happy till he be dead."

Croesus later lost his wealth and his life when Lydia was conquered in 546 BC by Cyrus of Persia, King of the largest empire in the world to that date.

Other kingdoms began minting coins, such as the Assyrians, Egyptians, and Persians.

The silver mines of Laurion enabled Athens to grow in power, leading the Delian League of Greek city-states. Their joint treasury was kept on the Island of Delos, considered the "Fort Knox" of the ancient world.

With this, Greeks were able to construct a navy with which to repel the first Persian invasion of Darius the Great at the Battle of Marathon in 490 BC, and the second Persian invasion under Xerxes in 480 BC at the Battle of Salamis.

With this, Greeks were able to construct a navy with which to repel the first Persian invasion of Darius the Great at the Battle of Marathon in 490 BC, and the second Persian invasion under Xerxes in 480 BC at the Battle of Salamis.

In 454 BC, the treasury was moved to Athens, where Pericles borrowed from it to construct the Parthenon of the Acropolis hill.

Philip's son, Alexander the Great, used gold from these mines to finance his military exploits, conquering Egypt, Persia, and all the way to India, 336 to 323 BC, having the largest empire in the world to that date.

The Romans conquered till they had the largest empire in the world to that date.

The basic Roman unit of money was a denarius.

“'Is it lawful for us to pay taxes to Caesar, or not?' ... Jesus said to them 'Show Me a denarius. Whose likeness and inscription does it have?' They said, 'Caesar's.' And He said to them, 'Then render to Caesar the things that are Caesar’s, and to God the things that are God’s.'” (NASB Luke 20:22-25)

Methods of cheating developed.

One was clipping off the edges of coins. To prevent this, coins were minted with ridges around the edges.

Another, used by Egyptian and Roman governments, was to mix in less expensive base metals with the gold, silver, or copper, thus debasing the coins.

Eventually, coins lost their "intrinsic" value and simply took on a "token" value.

Decades of irresponsible policies weakened Rome's economy:

- out-of-control government spending;

- enormous government debt;

- continual expensive wars; and

- government projects and welfare programs.

Hyper-inflation was followed by Diocletian's infamous wage and price controls, which caused people to abandon their debts and leave.

To prevent people from running away from their debts, Diocletian commanded that men, women, and children, be tied to their debts and mortgaged lands.

Rome collapsed, but this policy continued for centuries as the Medieval feudal system.

Deuteronomy 28:1-44:

"If thou shalt hearken diligently unto the voice of the Lord thy God ... The Lord shall ... bless all the work of thine hand: and thou shalt lend unto many nations, and thou shalt not borrow ... But ... if thou wilt not hearken unto the voice of the Lord thy God ... these curses shall come upon thee ... The stranger that is within thee shall get up above thee very high; and thou shalt come down very low. He shall lend to thee, and thou shalt not lend to him."

Another development was paper currency.

In the 13th century, Genghis Khan conquered from Korea to Hungary, having the largest empire in the world to that date. His grandson, Emperor Kublai Khan had China's Yuan Dynasty be the first major world power to use paper currency.

Unfortunately he printed too much of it and it became devalued, contributing to the Empire's collapse.

In Europe, rather than carrying around heavy bags of coins, individuals would store their gold and silver in secure "banking houses."

In the 15th century, the House of Medici was the largest banking house in Europe.

This allowed the family to play a major role in European politics, including producing four Popes and two Queens of France, and supporting Renaissance artists such as Michelangelo, Raphael, Donatello, and Leonardo da Vinci.

Shakespeare wrote in the play Hamlet, Act 1, Scene 3:

“Neither a borrower nor a lender be; For loan oft loses both itself and friend.”

Mark Twain wrote:

“A banker is a fellow who lend his umbrella when the sun is shining and wants it back the minute it begins to rain.”

Paper currency was convenient.

When conducting a transaction, a customer could simply write a note with their signature, which the merchant would later take to the banking house and exchange for coins.

Banking houses realized that not all the money was used everyday, so they would keep a reserve amount for day-to-day transactions and lend the rest out at interest, thus making a profit.

Banks began printing their own currency notes, and as there were little means of regulating them, unscrupulous over-printing could occur.

When a currency is no longer backed by precious metals it is called a "fiat" currency.

"Fiat" is Italian for "let it be done," or, in other words, it is worth something just because the government declares it to be worth something.

The Continental Congress printed a fiat currency, called a "Continental," which was not backed by gold or silver.

It lost nearly all its value, giving rise to the phrase: "not worth a Continental."

In the 16th century, Spain had the largest empire in the world to that date.

Ben Franklin, in The Way to Wealth, 1758, referenced the debt induced decline of the Spanish Empire:

"If you would be wealthy, says he ... think of saving as well as of getting: the Indies have not made Spain rich, because her outgoes are greater than her incomes."

He wrote:

“The colonies would gladly have borne the little tax on tea and other matters had it not been that England took away from the colonies their money, which created unemployment and dissatisfaction.

The inability of colonists to get power to issue their own money permanently out of the hands of George III and the international bankers was the prime reason for the Revolutionary War.”

Learning this lesson, the U.S. Constitution did not give the Federal government permission to print currency, only authority to mint coins, with a value tied to the stable Spanish silver dollar (Article 1, Sec. 8):

“Congress shall have power … to coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures."

Roger Sherman, a signer of the Constitution, authored Article 1, Section 10:

"No State shall ... make anything but gold and silver coin a tender in payment of debts."

Sherman wrote in A Caveat Against Injustice or, An Inquiry into the Evils of a Fluctuating Medium of Exchange, 1752:

"(Currency) bills of credit are of no intrinsic value, and their ... value is fluctuating and very uncertain, and therefore it would be unjust that any person should be obliged to receive them in payment as money ... Money ought to be something of certain value, it being that whereby other things are to be valued."

James Madison wrote:

"Paper money is unjust ... It is unconstitutional, for it affects the rights of property as much as taking away equal value in land."

George Washington wrote Thomas Jefferson, August 1, 1786:

"Paper money has had the effect in your state ... to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice."

Jefferson wrote to Colonel Edward Carrington, May 27, 1788:

"Paper is poverty ... it is only the ghost of money, and not money itself."

In 1817, Jefferson predicted paper money will bring:

"... abuses also are inevitable and, by breaking up the measure of value, make a lottery of all private property."

Jefferson wrote to John Wayles Eppes, 1813:

"Bank-paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs."

Jefferson wrote to John Taylor in May 26, 1816:

"The system of banking we have both equally and ever reprobated. I contemplate it as a blot left in all our constitutions, which, if not covered, will end in their destruction, which is already hit by the gamblers in corruption, and is sweeping away in its progress the fortunes and morals of our citizens ...

And I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale."

Franklin share his wisdom on debt:

"When you run in debt; you give to another power over your liberty ...

If you cannot pay at the time, you will be ashamed to see your creditor; you will be in fear when you speak to him, you will make poor pitiful sneaking excuses, and by degrees come to lose your veracity, and sink into base downright lying;

for, as Poor Richard says, the second vice is lying, the first is running in debt ... Lying rides upon debt's back."

This is similar to the Greek historian Herodotus, who gave an account of Persia during the 5th century BC:

'The most disgraceful thing in the world (as Persians) think, is to tell a lie; the next worst, to owe a debt: because, among other reasons, the debtor is obliged to tell lies.'"

Franklin added:

"Poverty often deprives a man of all spirit ... 'tis hard for an empty bag to stand upright, as Poor Richard truly says ... And yet you are about to put yourself under that tyranny when you run in debt for such dress!

Your creditor has authority at his pleasure to deprive you f your liberty, by confining you in gaol (jail) for life, or to sell you for a servant, if you should not be able to pay him!

When you have got your bargain, you may, perhaps, think little of payment; but creditors, Poor Richard tells us, have better memories than debtors ...

The day comes round before you are aware, and the demand is made before you are prepared to satisfy it ... "

Franklin continued:

"Those have a short Lent, saith Poor Richard, who owe money to be paid at Easter.

Then since, as he says, the borrower is a slave to the lender (Proverbs 22:7) and the debtor to the creditor, disdain the chain, preserve your freedom; and maintain your independency: be industrious and free; be frugal and free.

At present, perhaps, you may think yourself in thriving circumstances, and that you can bear a little extravagance without injury; but, For age and want, save while you may; No morning sun lasts a whole day, as Poor Richard says.

Gain may be temporary and uncertain, but ever while you live, expense is constant and certain ...

as Poor Richard says. So rather go to bed supperless than rise in debt."

U.S. Superintendent of Finance Robert Morris had raised money to finance the Continental Army.

After the War, he and Alexander Hamilton, with the support of Franklin, founded the Bank of North America in 1781.

It was the nation's first de facto central bank with the goal of providing a stable currency necessary for international trade.

On February 25, 1791, Hamilton arranged for the Bank of North America to be replaced by the Bank of the United States.

Thomas Jefferson, James Madison, and U.S. Attorney General Edmund Randolph were critical of the nation's first "centralized" bank as it concentrated too much power into the hands of too few.

The Bank of the United States was a private institution which had foreign investors as stockholders, though they were not allowed to vote.

William Pitt was the Prime Minister of Great Britain, the largest empire in the world to that date.

He saw his country's nation's debt doubled to £243 million during the American Revolutionary War. He stated:

"Let the American people go into their debt-funding schemes and banking systems, and from that hour their boasted independence will be a mere phantom."

Hamilton also founded the Bank of New York in 1784, (later merged with Mellon), which loaned money to pay the salaries of Congress.

In 1789, Hamilton became the first U.S. Secretary of the Treasury.

In 1799, Aaron Burr founded Manhattan Water Company under the auspices of bringing fresh water into New York City, but used the majority of the money to start a bank to compete with Hamilton, The Manhattan Bank (later merged with Chase).

In 1800, Burr used his Bank's resources to influence elections.

Jefferson accused the Bank of the United States of doing the same thing, having become:

"a machine for the corruption of the legislature."

In 1811, James Madison refused to recharter the Bank of the United States.

As British financiers reportedly owned two-thirds of the stock of the Bank of the United States, this may have been a factor precipitating the War of 1812.

France, the second largest empire in the world at this date, also incurred enormous debt from helping America win independence from Britain.

This destabilized the France, leading to King Louis XVI being forced from the throne and then beheaded on January 21, 1793.

The French Republic was formed, but by 1799 it was bankrupt, setting the stage for Napoleon to take power.

Wilson R. McNair's book, Monarchy or Money Power (1933), stated:

"It was ordained by Napoleon that money should not be exported from France on any pretext whatever except with the consent of the Government,

and that in no circumstances should loans be employed to meet current expenditure whether civil or military.

The object was to withhold from finance the power to embarrass the Government as it had embarrassed the Government of Louis XVI.

... When a Government, Bonaparte declared, is dependent for money upon bankers, they and not the leaders of that Government control the situation, since 'the hand that gives is above the hand that takes' ...

'Money,' he declared, 'has no motherland; financiers are without patriotism and without decency: their sole object is gain.'”

An important banking family in Frankfurt, Germany, was that of Mayer Amschel Rothschild (1743–1812). His five sons led branches which significantly shaped Europe in the next century:

- Amschel Mayer Rothschild, Frankfurt;

- Salomon Rothschild, Vienna;

- Karl Rothschild, Naples;

- James Rothschild, Paris;

- Nathan Meyer Rothschild, London.

Nathan Rothschild helped finance the Duke of Wellington's British armies against Napoleon in Spain and France.

A legend persists that Nathan Rothschild obtained early information of the British victory over Napoleon at the Battle of Waterloo, June 18, 1815.

He began to sell his shares on the London Stock Exchange, leading investors to suspect he had inside information that the British lost the battle, resulting in a panic-selling off of stocks.

The story continued that Rothschild bought up devalued shares at low prices, and when news arrived the next day that the British had actually won the Battle of Waterloo, the stock market enthusiastically exploded, resulting in Rothschild making a million pounds sterling in a day.

A maxim attributed to the House of Rothschild was:

"Let us control the money of a nation, and we care not who makes its laws."

On April 10, 1816, the Second Bank of the United States received its charter.

By 1822, the rechartered Second Bank of the United States was run by Nicholas Biddle who boasted of having more personal power than the President.

He set interest rates and reserve requirements, which allowed him to amass an enormous personal wealth.

Biddle bought political influence by financing the election campaigns of politicians.

He owned newspapers and would have them editorialize and sway voters during elections.

Ambitious politicians sought his money and his ability to provide favorable media coverage.

On JULY 10, 1832, President Andrew Jackson vetoed the charter renewal of Nicholas Biddle's Second Bank of the United States, stating:

"Some of powers and privileges possessed by the existing Bank are unauthorized by the Constitution, subversive to the rights of the States, and dangerous to the liberties of the people ...

It is easy to conceive that great evils to our country and its institutions might flow from such a concentration of power in the hands of a few men irresponsible to the people ...

... Their power would be great whenever they might choose to exert it ... to influence elections or control the affairs of the nation.

But if any private citizen or public functionary should interpose to curtail its powers or prevent a renewal of its privileges, it cannot be doubted that he would be made to feel its influence ..."

Jackson continued:

"Controlling our currency, receiving our public moneys, and holding thousands of our citizens in dependence, it would be more formidable and dangerous than the naval and military power of the enemy."

Economist John Maynard Keynes held a similar view, as he wrote in his book The Economic Consequences of the Peace (1920, reprinted 1971, p. 235):

"Lenin is said to have declared 'The best way to destroy the capitalist system is to debauch the currency.'"

On September 18, 1833, President Andrew Jackson decided to remove all Federal money out of Nicholas Biddle's Second Bank of the United States:

"The Bank is thus converted into a vast electioneering engine, with means to embroil the country in deadly feuds, and ... extend its corruption through all the ramifications of society ...

... The President would feel that he was ... an accomplice in a conspiracy against that Government ... if he did not take every step within his constitutional and legal power ... to ... putting an end to these enormities ...

Was it expected when the moneys of the United States were directed to be placed in that Bank that they would be put under the control of one man? ...

... This corporation now holds in its hands the happiness and prosperity of the American people, it is high time to take the alarm.

If the despotism be already upon us and our only safety is in the mercy of the despot ... how necessary it is to shake it off ...

One of the most serious objections to the Bank of the United States is the power which it concentrates."

On December 3, 1833, in his 5th Annual Message, President Andrew Jackson condemned Nicholas Biddle's Second Bank of the United States:

"This great and powerful institution had been actively engaged in attempting to influence the elections of the public officers by means of its money ...

It being thus established by unquestionable proof that the Bank of the United States was converted into a permanent electioneering engine ...

The efforts of the Bank to control public opinion, through the distresses of some and the fears of others ...

Through presses known to have been sustained by its money it attempts by unfounded alarms to create a panic in all."

President Andrew Jackson, whose wife died right before he took office, stated in a Protest Message to the Senate, April 15, 1834:

"The Bank of the United States, a great moneyed monopoly, had attempted to obtain a renewal of its charter by controlling the elections of the people ... to control public opinion and force the Government to yield to its demands ...

The only ambition I can feel is to acquit myself to Him to whom I must soon render an account of my stewardship ...

to persuade my countrymen, so far as I may, that it is not in a ... government supported by powerful monopolies ... that they will find happiness ... but in a plain system, void of pomp, protecting all and granting favors to none, dispensing its blessings, like the dews of Heaven."

On December 1, 1834, in his 6th Annual Message, President Jackson stated:

"Events have satisfied my mind, and I think the minds of the American people, that the mischief and dangers which flow from a national Bank far overbalance all its advantages.

The bold effort the present Bank has made to control the Government, the distresses it has wantonly produced, the violence of which it has been the occasion in one of our cities famed for its observance of law and order,

are but premonitions of the fate which awaits the American people should they be deluded into a perpetuation of this institution or the establishment of another like it."

On January 30, 1835, in the midst of the "Bank War," Jackson survived an assassination attempt when Richard Lawrence fired two pistols at him at point blank range.

Perhaps due to the humid, foggy weather in Washington, D.C., the guns misfired.

Davy Crockett, who was with the President, ran up and wrestled the assailant, disarming him.

Senator Thomas Hart Benton of Missouri wrote January 30, 1835 of how the incident:

"... irresistibly carried many minds to the belief in a superintending Providence, manifested in the extraordinary case of two pistols in succession -- so well loaded, so coolly handled, and which afterwards fired with such readiness, force,and precision -- missing fire each in his turn, when leveled eight feet at the President's heart."

When King William IV of England heard of the incident, he wrote expressing his concern. President Jackson wrote back:

"A kind of Providence had been pleased to shield me against the recent attempt upon my life, and irresistibly carried many minds to the belief in a superintending Providence."

On December 7, 1835, in his 7th Annual Message, Jackson stated:

"We have felt but one class of these dangers exhibited in the contest waged by the Bank of the United States ...

The Bank is, in fact, but one of the fruits of a system at war with the genius of all our institutions ... whose great ultimate object and inevitable result ... is the consolidation of all power in our system in one central government.

Lavish public disbursements and corporations with exclusive privileges would be its substitutes for the original ... checks and balances of the Constitution ...

Wherever this spirit has effected an alliance with political power, tyranny and despotism have been the fruit ... It has to be incessantly watched, or it corrupts ...

All history tells us that a free people should be watchful of delegated power, and should never acquiesce in a practice which will diminish their control over it."

On December 5, 1836, in his 8th Annual Message, President Andrew Jackson stated:

"It was in view of these evils, together with the dangerous power wielded by the Bank of the United States and its repugnance to our Constitution, that I was induced to exert the power conferred upon me by the American people to prevent the continuance of that institution ...

The lessons taught by the Bank of the United States cannot well be lost upon the American people. They will take care never again to place so tremendous a power in irresponsible hands."

Jackson, who was the only President to pay off the national debt, stated in his Farewell Address, March 4, 1837:

"The distress and alarm which pervaded and agitated the whole country when the Bank of the United States waged war upon the people in order to compel them to submit to its demands cannot yet be forgotten ...

The Government would have passed from the hands of the many to the hands of the few, and this organized money power from its secret conclave would have dictated the choice of your highest officers and compelled you to make peace or war, as best suited their own wishes.

The forms of your Government might for a time have remained, but its living spirit would have departed from it ..."

Jackson continued:

"The distress ... inflicted on the people by the Bank are some of the fruits of that system of policy which is continually striving to enlarge the authority of the Federal Government beyond the limits fixed by the Constitution ...

The power which moneyed interest can exercise, when concentrated under a single head and with our present system of currency, was sufficiently demonstrated in the struggle made by the Bank of the United States ..."

Economist Milton Friedman stated:

"Concentrated power is not rendered harmless by the good intentions of those who create it."

Henry Ford wrote:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Jackson continued his Farewell Address, March 4, 1837:

"The paper-money system and its natural associations -- monopoly and exclusive privileges -- have already struck their root too deep in the soil, and it will require all your efforts to check its further growth and to eradicate the evil ...

The men who profit by the abuses and desire to perpetuate them will continue to besiege the halls of legislation in the General Government ... and will seek by every artifice to mislead and deceive the public servants ...

You have no longer any cause to fear danger from abroad; your strength and power are well known throughout the civilized world ...

It is from within, among yourselves -- from cupidity, from corruption ... and inordinate thirst for power -- that factions will be formed and liberty endangered.

It is against such designs, whatever disguise the actors may assume, that you have especially to guard yourselves ...

... Providence has showered on this favored land blessings without number, and has chosen you as the guardians of freedom, to preserve it for the benefit of the human race.

May He who holds in His hands the destinies of nations, make you worthy of the favors He has bestowed,

and enable you, with pure hearts and hands and sleepless vigilance, to guard and defend to the end of time, the great charge He has committed to your keeping."

--

American Minute is a registered trademark of William J. Federer. Permission granted to forward, reprint, or duplicate.

--

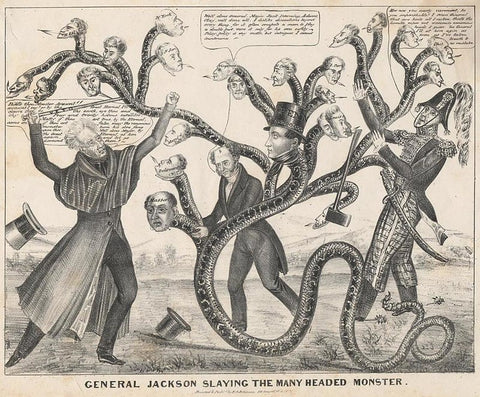

Image Credits: Public Domain; Description: A satire on Andrew Jackson's campaign to destroy the Bank of the United States and its support among state banks. Jackson, Martin Van Buren, and Jack Downing struggle against a snake with heads representing the states. Jackson (on the left) raises a cane marked "Veto" and says, "Biddle thou Monster Avaunt!! avaount I say! or by the Great Eternal I'll cleave thee to the earth, aye thee and thy four and twenty satellites. Matty if thou art true...come on. if thou art false, may the venomous monster turn his dire fang upon thee..." Van Buren: "Well done General, Major Jack Downing, Adams, Clay, well done all. I dislike dissentions beyond every thing, for it often compels a man to play a double part, were it only for his own safety. Policy, policy is my motto, but intrigues I cannot countenance." Downing (dropping his axe): "Now now you nasty varmint, be you imperishable? I swan Gineral that are beats all I reckon, that's the horrible wiper wot wommits wenemous heads I guess..." The largest of the heads is president of the Bank Nicholas Biddle's, which wears a top hat labeled "Penn" (i.e. Pennsylvania) and "$35,000,000." This refers to the rechartering of the Bank by the Pennsylvania legislature in defiance of the adminstration's efforts to destroy it; Date: 1836; Source: Brown University Library Center for Digital Initiatives, Print, Drawings & Watercolors from the Anne S. K. Brown Military Collection, ID 119817787962500; Author: N.Y. : Printed & publd. by H.R. Robinson, 1833; https://commons.wikimedia.org/wiki/File:General_Jackson_Slaying_the_Many_Headed_Monster_(cropped).jpg

This is excellent. Knowledge of monetary history is so extremely important. Thank you, Bill.